Trump Tax Plan Brackets Chart

One of the major victories for the Trump administration.

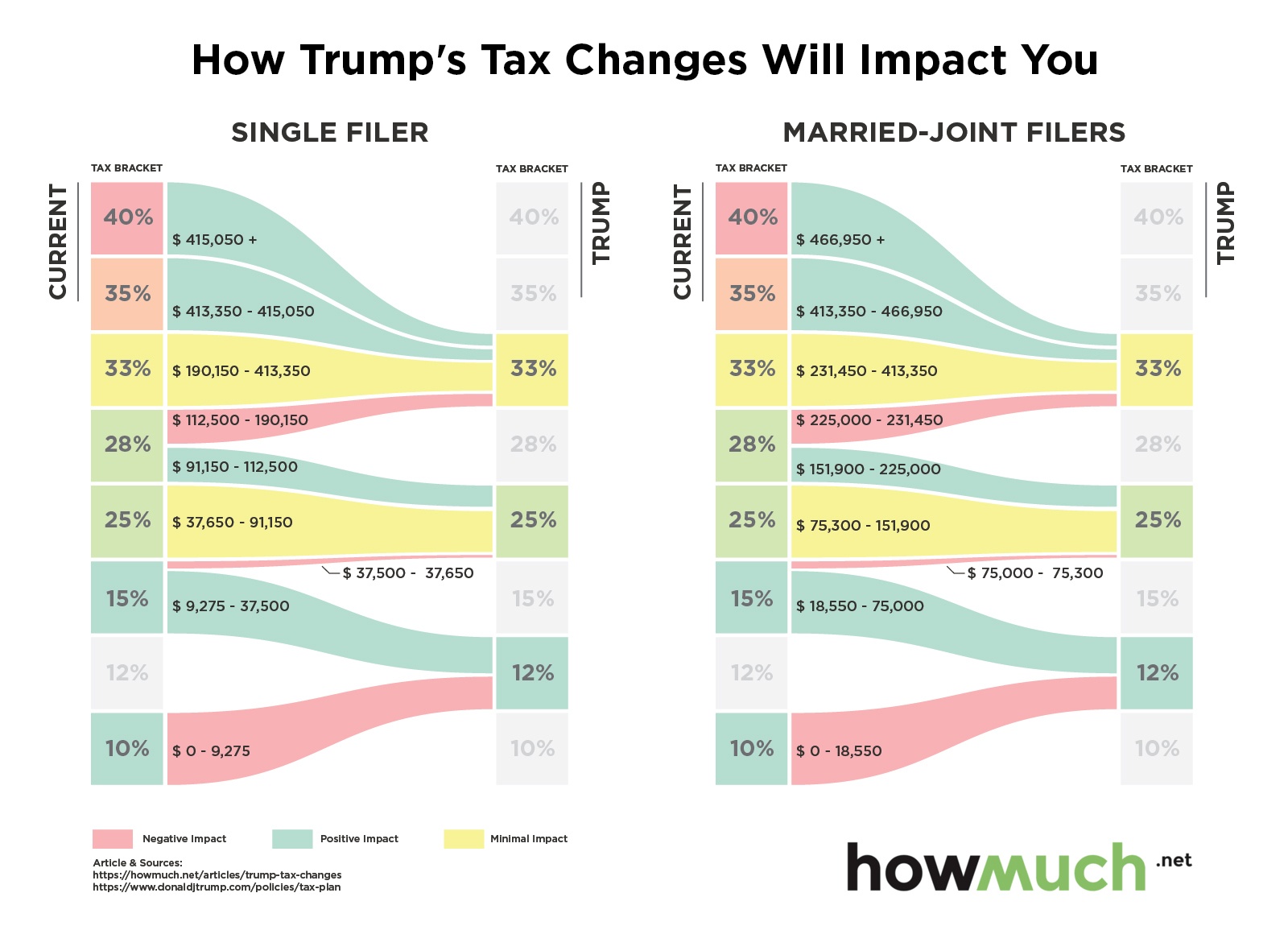

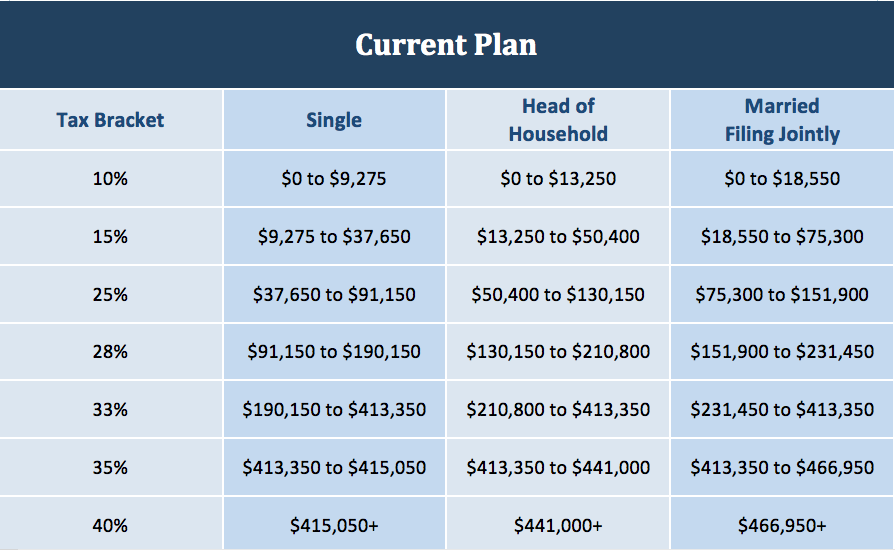

Trump tax plan brackets chart. The plan would reduce the number of individual income tax brackets from the current seven brackets to three with rates of 10 20 and 25 percent table 1. Raise the top marginal individual income tax rate for incomes above 400000 to the pre-TCJA rate of 396. Those making between 25000.

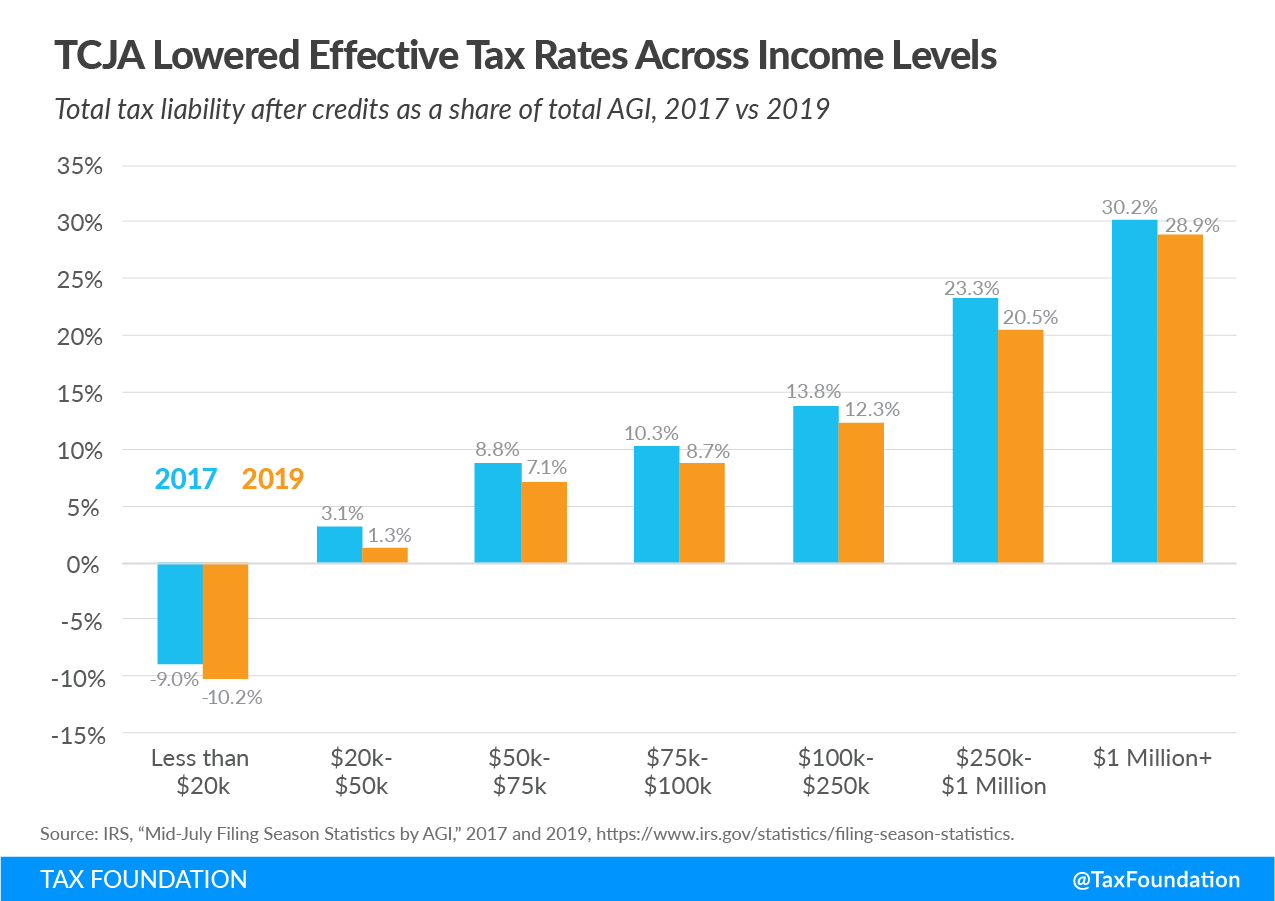

The Tax Cuts and Jobs Act came into force when President Trump signed it. Income Tax Rates. November 3 2021 Tax.

President Biden is proposing an increase to the corporate tax ratealthough not fully back to pre-Trump. A Simpler Tax Code For All Americans When the income tax was first introduced just one percent of Americans had to pay it. 2 2021 Federal Tax Brackets Chart.

204 Head of Household. The chart below shows what we know so far about how Trumps tax plan could change federal income-tax brackets. 205 Standard Deduction Amounts.

If you know your yearly. 202 Married Filing Jointly or Qualifying Widow er 203 Married Filing Separately. The Trump Tax Plan.

Or redundant by the new lower tax rates on individuals and companies. 10 12 22 24 32 35 and 37. He wants to reduce the number of individual tax bands from seven to three.

It lowered the corporate tax rate to 21 from 35 at the turn of 2018. They both reduce the number of. 42 million households that.

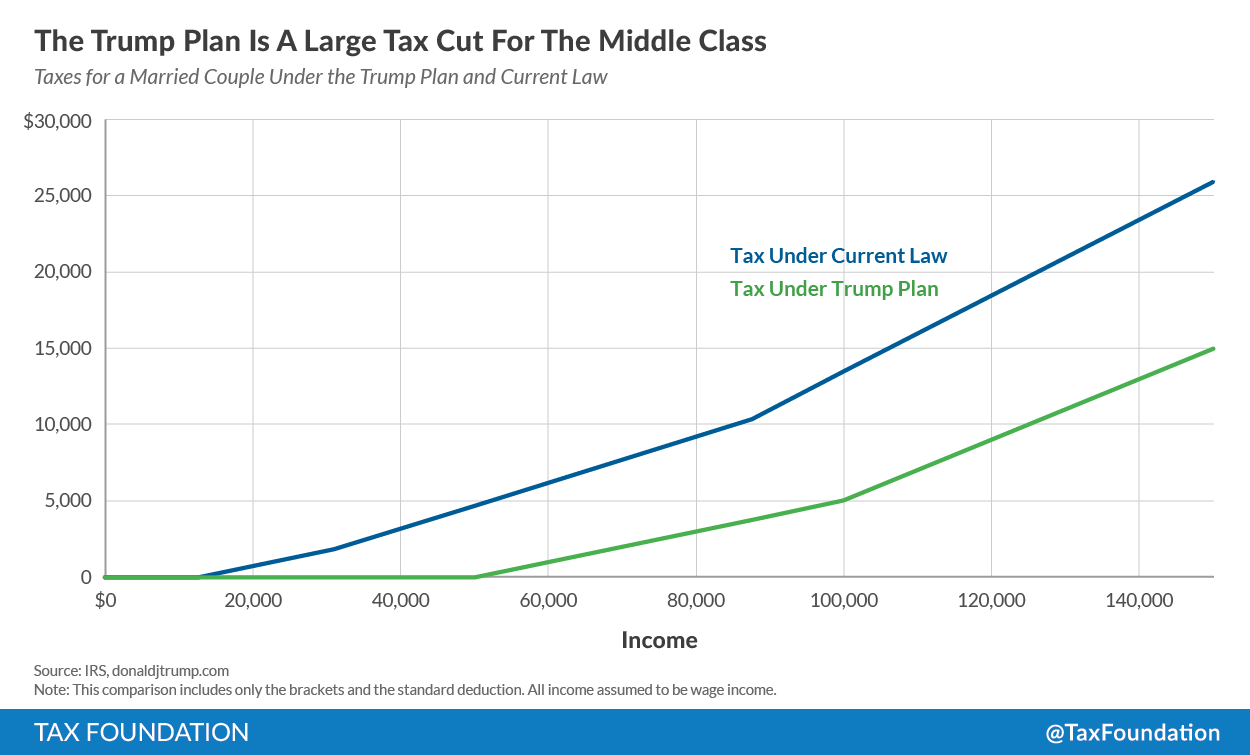

Small business owners who are setup as S-Corporations or Limited Liability companies and receive pass-through income via a K-1 or form 1065 will be allowed to deduct 20 of their income prior to applying the personal income tax rates up to certain qualifying income limits and the corporate. As youll see in the chart below Trumps tax plan is a simplification. Trumps plan would reduce the current seven tax brackets to four with a 0 percent rate applying to all those making less than 25000 50000 for married couples.

Below is a chart that contains all you need to know about the. Cap the value of itemized deduction to 28 thereby reducing the benefit for taxpayers in rate brackets higher than 28. It was never intended as a tax most Americans would pay.

Increases the standard deduction to 11300 for single filers and 22600 for joint filers. 12 25 35 and 396. 3 2021 Federal Tax Brackets Chart.

In a speech in August Trump indicated he would align his proposed individual income tax rates with that of the House Republicans tax reform plan. Tax long-term capital gains and dividends above 1 million at the ordinary income rate of 396. Trumps tax plan proposes four federal income tax brackets.

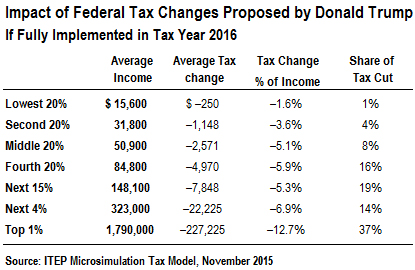

Download Attached DocumentBoth Hillary Clinton and Donald Trump have released tax plans during the campaignThe Tax Foundation has analyzed both the plans using our Taxes and Growth TAG model to estimate how their plans would impact taxpayers federal revenues and economic growth. Income brackets. There are still seven federal income tax.

The personal tax brackets will be as follows. The top rate applies to taxable income over 85750 for single filers and 141200 for joint filers. The highest tax bracket is now 37 for big earners.

Under the Houses plan there would be four federal income-tax brackets rather than the seven we have today. The law retained the old structure of seven individual income tax. Establishes three tax brackets with rates of 10 25 and 28.

8 rows Biden vs. See How Trumps Tax Plan Will Change Things. The brackets proposed are 12 25 35 and 396.

Under Trumps tax plan the corporate tax rate dropped from 35 percent to 21 percent. 8 rows The chart below shows the tax brackets from the Trump tax plan. It would cut the top 396 percent.

The Trump plan eliminates the income tax for over 73 million households.