Retirement Savings By Age Chart

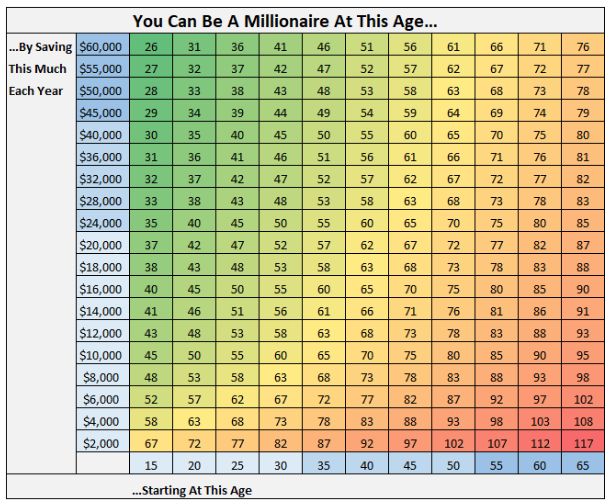

Saving 15 of income per year including any employer contributions is an appropriate savings level for many people.

Retirement savings by age chart. So when we pull out that group of people and only look at those who had savings in the same age group from age 45 64 they averaged 345000 for retirement savings. Chart 15 Of Americans Aged 60 Have No Retirement Savings Statista. To be in the top 5 for this age range your household would need an retirement savings of 711000.

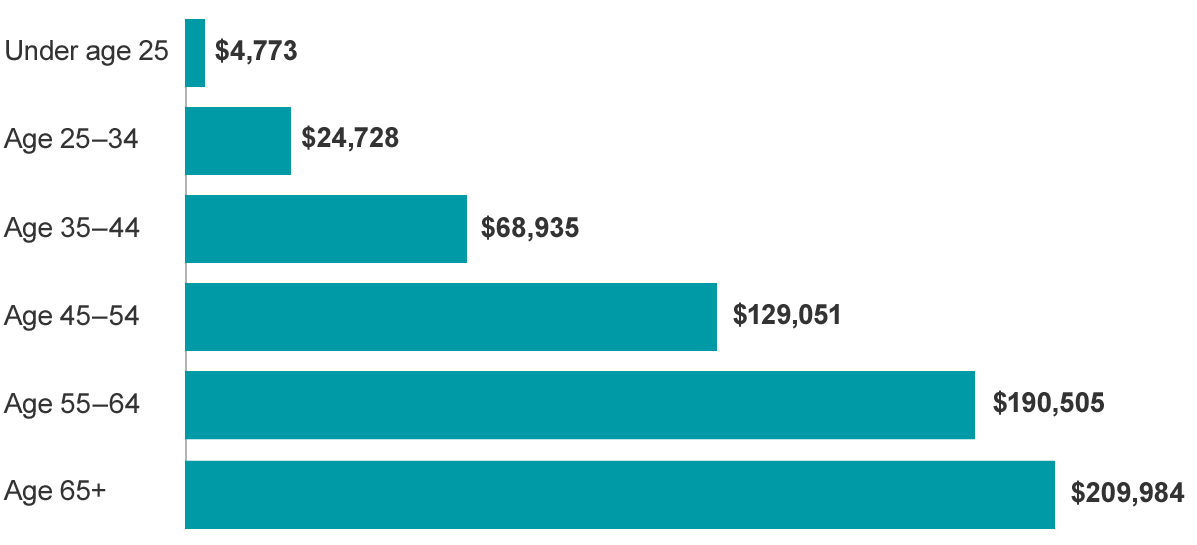

The table below shows the average amount of retirement savings based on research from the 2019 Survey of Consumer Finances the Federal Reserves most recent survey to date. Aim to save 5 to 15 of your income for retirement or start with a. Be skeptical of top percentiles.

Lets take a look at the average retirement savings by age for people between 30-69. Different age groups see life differently. This calculator provides only an estimate of your benefits.

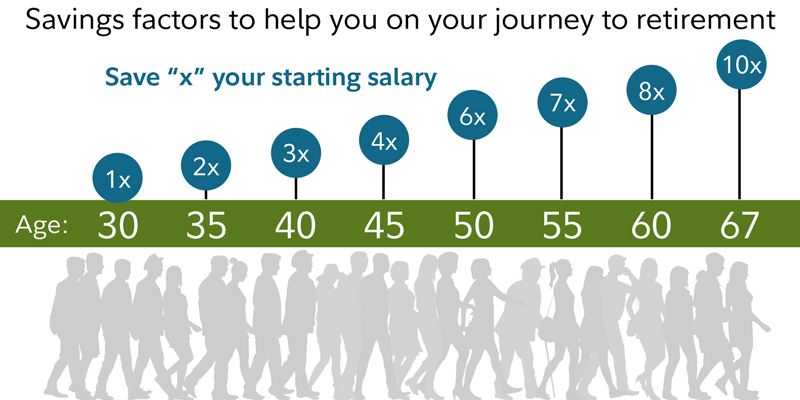

A general rule of thumb is to have one times your income saved by age 30 three times by 40 and so on. Average Retirement Savings By Age. When you take.

By age say 45 with yearly income of 80000 your target multiple rises to 36 times your income. Consider numbers in or around the listed amount. Ideally it should be closer to 67000.

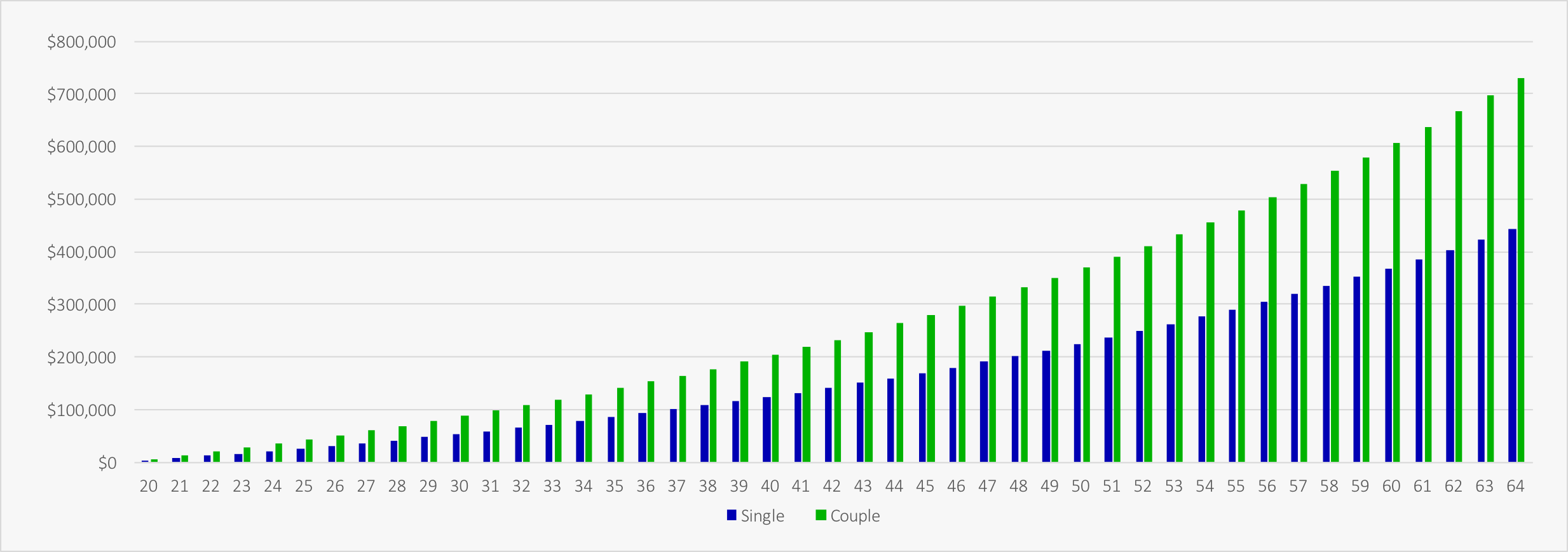

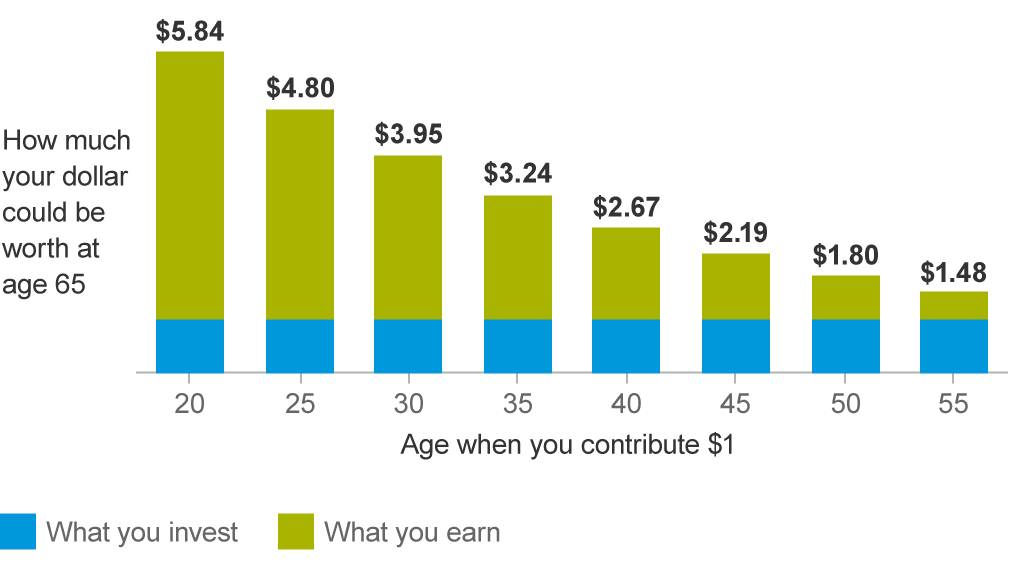

So if you multiply 80000 by 36 or by 360 your retirement savings should total 288000 by. 72 of all respondents 25-32 had 49999 or less saved for retirement. The sooner you start saving for retirement the longer youll have to take advantage of the power of compound interest.

2 This may seem lofty but stay on track and it will be well worth it when you are ready to leave the workforce and enjoy your retirement. For overall households the top 1 retirement savings was 177050000 while a more expansive definition of retirement savings came in at 443680000 for the top 1. Savings benchmarks based on age and salary can serve as a helpful way to track progress against saving for retirement.

For a 62-year-old this allowance is 2324. Having one to one-and-a-half times your income saved for retirement by age 35 is an attainable target for. What to Consider When Saving for Retirement.

Full retirement age chart. But one need not worry if they havent started that early in life. Age Group Average Retirement Savings.

Saving or investing for the purpose of retirement should start right from the time one starts working. The median amount saved in this age group was 12000. The chart also shows about how much youd need to save to accumulate the retirement account balance necessary to produce each income amount by the age of 65.

Retirement Full Age Chart Minimum age for Social Security Retirement is Age 62. Wealth In Great Britain Wave 5 Office For National Statistics. Have eight times your annual salary saved.

By age 40. The focus on retirement is reflected in the average savings by age 60 with data showing you should have at least 16554 to 33108 in savings but 433559 or 7 times your income in retirement savings. Savings for Retirement By Age.

Looking at a Social security retirement age chart can give you. Pension Wealth In Great Britain Office For National Statistics. Retirement Planning Tool Visual Calculator.

Have six times your annual salary saved. The calculations use the 2017 FICA income limit of 127200 with an annual maximum Social Security benefit of 32244 per year 2687. Uk State Pension Worst In Developed World And Has The Highest.

People in their 20s are more inclined to spending or saving for short-term goals rather than long-term ones. In this age group savings was greatly clustered toward the lower ranges. Average Retirement Age In The United States.

Retirement Savings Composition of Households like you. What is the top 1 retirement savings by age. From the CIBC retirement poll we noted above 32 of Canadians have nothing set aside for retirement.

According to Fidelity the following is what the average American has saved for retirement. Net worth in general is ill-behaved. Have 10 times your annual salary saved.

That makes the average for those folks pretty easy to estimate. Its based on the assumptions youll. Have three times your annual salary saved.

Average American Retirement Savings by Age. If you earn 50000 you should plan to have 150000 saved for retirement by 40. According to the Economic Policy Institute the average retirement savings of Americans ages between ages 32 and 37 was 32602 as of 2016.

Your retirement savings of 5000 for ages 18 to 100 ranks at the 562th percentile. This figure increases dramatically for savers in their late 30s and early 40s. What are the Best Retirement Plans as per your age.

.png)

:max_bytes(150000):strip_icc()/dotdash_final_6-Late-Stage-Retirement-Catch-Up-Tactics_Feb_2020-4c3d3dd8ab49428bb2f04afdb7b72948.jpg)

%20(1).png)

/average-retirement-savings-by-age-4155888_color2-dc8beecd73664342a6c7800d59b20c6e.gif)