Obamacare Income Limits 2017 Chart

My Money Blog has partnered with CardRatings and Credit-Land for selected credit cards and may receive a commission.

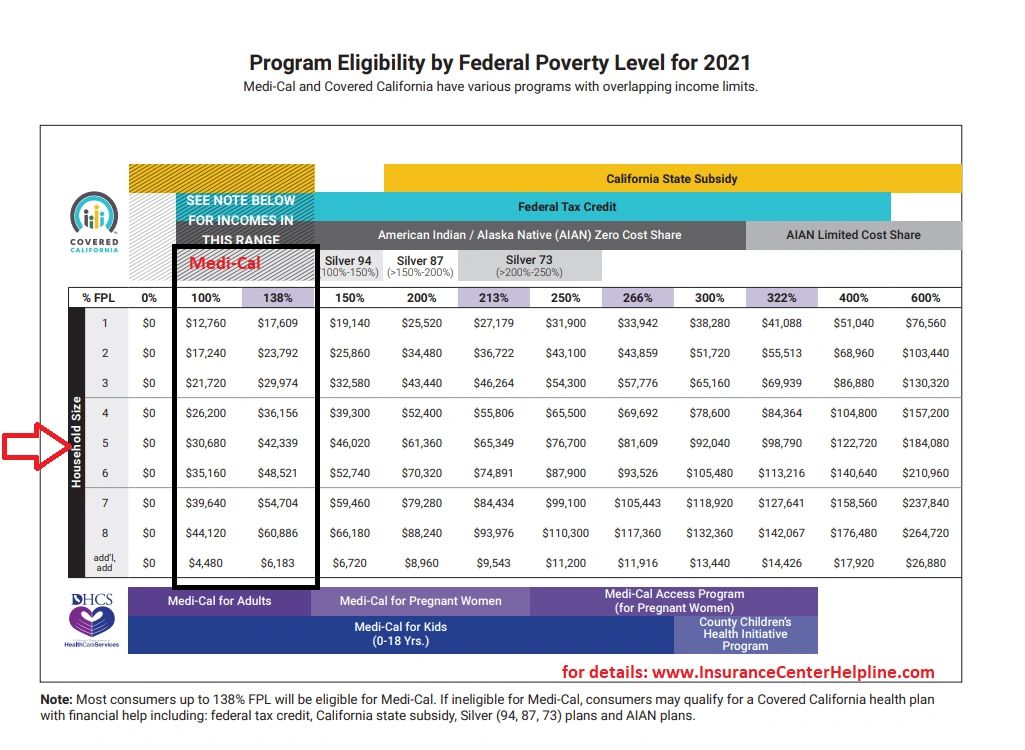

Obamacare income limits 2017 chart. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. With the Biden Health Reform people with incomes above 400 FPL can also opt for subsidies and will only pay up to 85 of their income for health coverage. Family of Four Annual Income.

More help before you apply. Higher than 20780 and lower than 83120. Family of Four Annual Income.

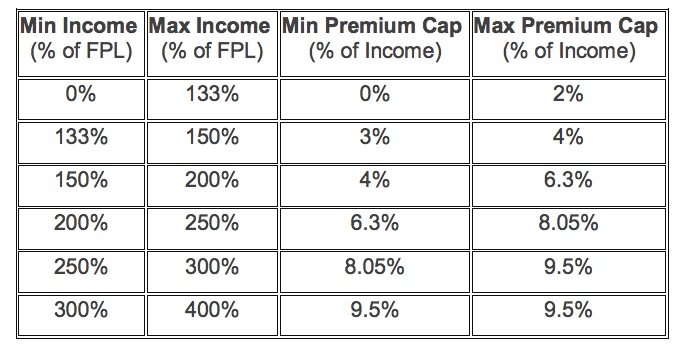

Cost Share Reduction Tier 1 limit. But for 2021 and 2022 this limit does not apply. 9 rows Income Bracket Chart.

Higher than 16460 and lower than 65580. Cost Share Reduction Tier 2 limit. You can probably start with your households adjusted gross income and update it for expected changes.

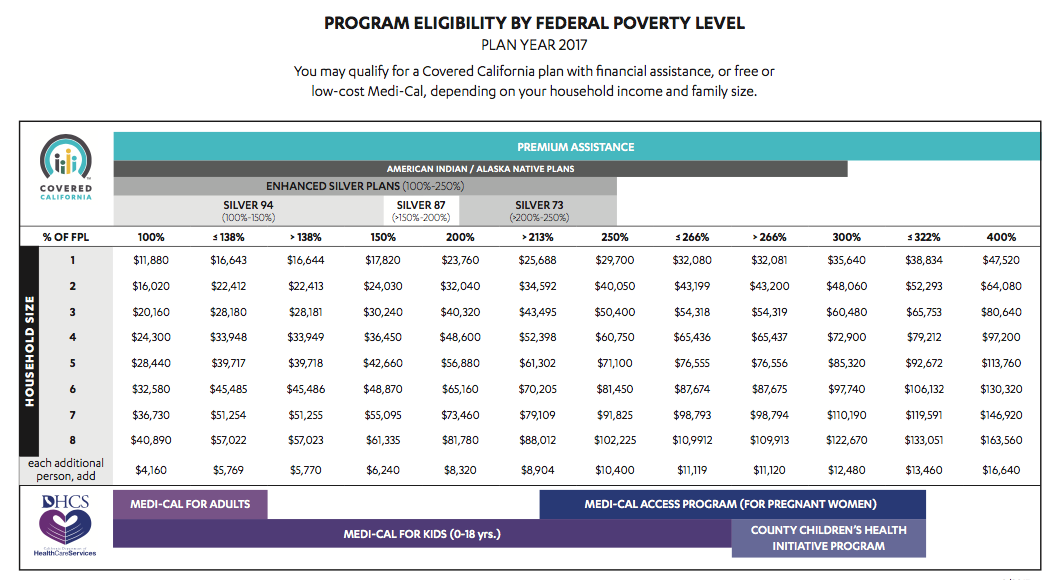

For each household family with more than 8 people 4320 per person should be added to the minimum and maximum limit. Lowest eligible income 100 FPL. During Annual Enrollment Period AEP you want to use your best estimate at what your income will be for 2017.

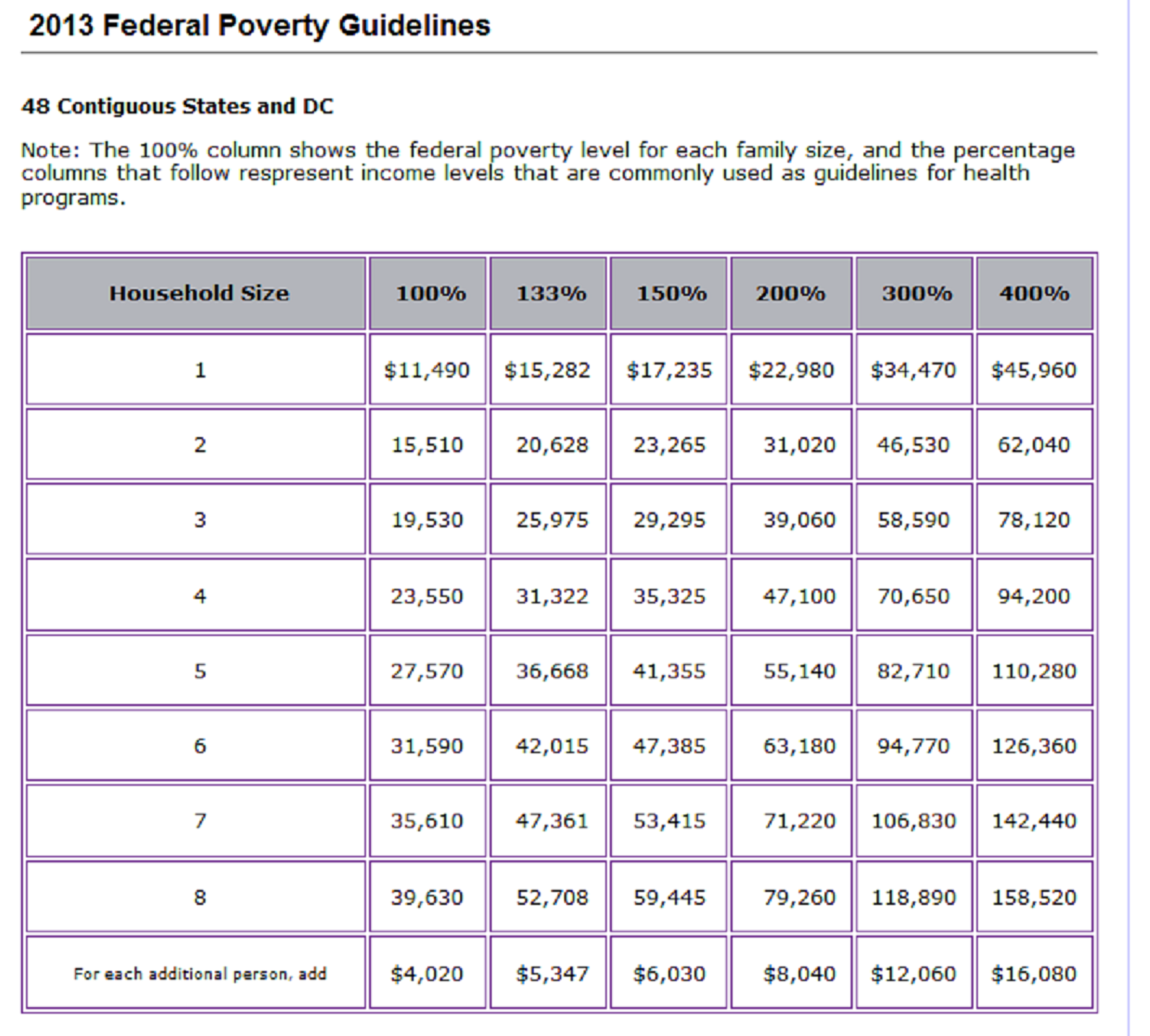

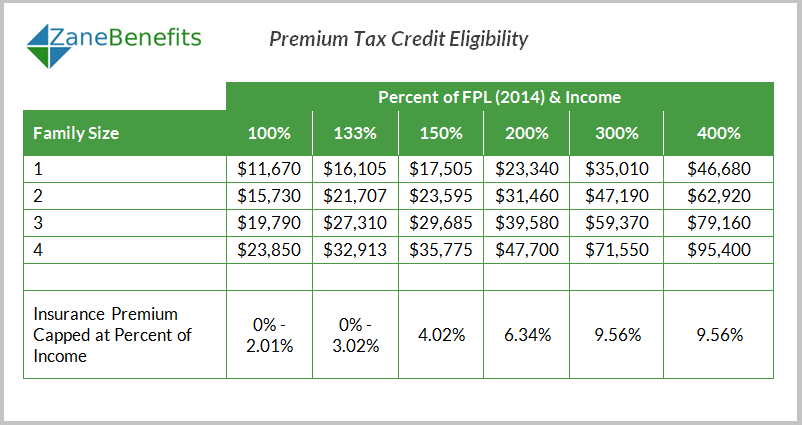

Income under 25100 to be exact for a family of four two adults two children 20780 for a family of three and 12140 for an individual are considered poverty levels in the United States. If your income is 100 higher and no more than 400 of the Federal Poverty Level then you are eligible for Obamacare subsidies. Higher than 12140 and lower than 48560.

Types of income to include in your estimate. And for 8 people household family. Open enrollment for obtaining health insurance from the.

So yes in years that you claim your son as a tax dependent youre considered a household of two and youd be eligible for a premium subsidy with an income of up to 400 of the poverty level for a household of two for 2021 coverage that will be 68960. Individual Annual Income. If your income is 100 higher and no more than 400 of the Federal Poverty Level then you are eligible for Obamacare subsidies.

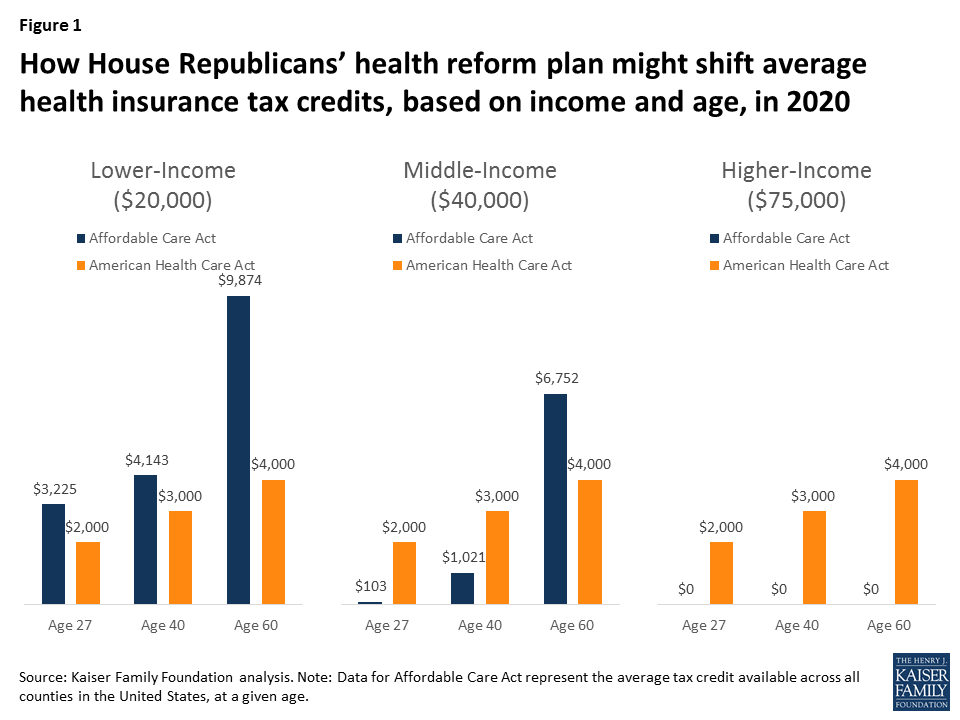

Previously if you earned more than 400 FPL you didnt qualify for any subsidies no matter how much the benchmark Silver plan cost. It is important to mention that Alaska and Hawaii are unique states and they have separate charts of their own. Cost Share Reduction Tier 3 limit.

The following 2017 United States FPL income brackets are for the. Table caption 2017 Federal Poverty Level FPL Chart classtable t able-striped tablesorter0 If your income falls below 100 you will not qualify for a subsidy. If you expect income types not shown or have additional questions see details on what the IRS counts as income.

Income type Include as income. It removed the Federal Poverty Level FPL income cap requirement. The income limit for subsidy eligibility is based on the size of your tax household.

For 7 people. All opinions expressed are the authors alone and has not been provided nor approved by any of the companies mentioned. Help to pay your premium if you buy in your states online marketplace Between 12760-51040.

1 days ago The chart states that you are eligible for Obamacare subsidies for 2019 if your household income is at least 100 higher than the percent of the FPL in 2018 or in other terms. Analysis Of Income Limits For Subsidies Poverty levels are dependent on FPL. Individual Annual Income.

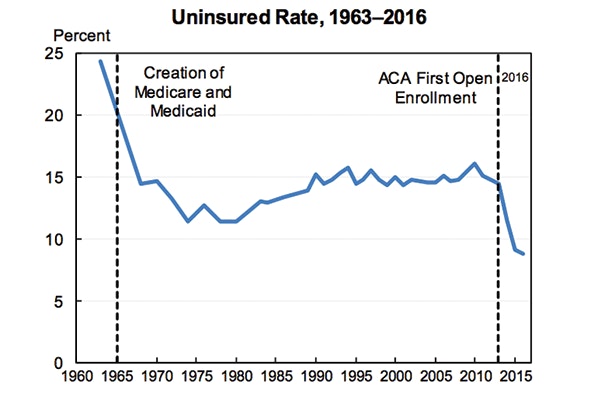

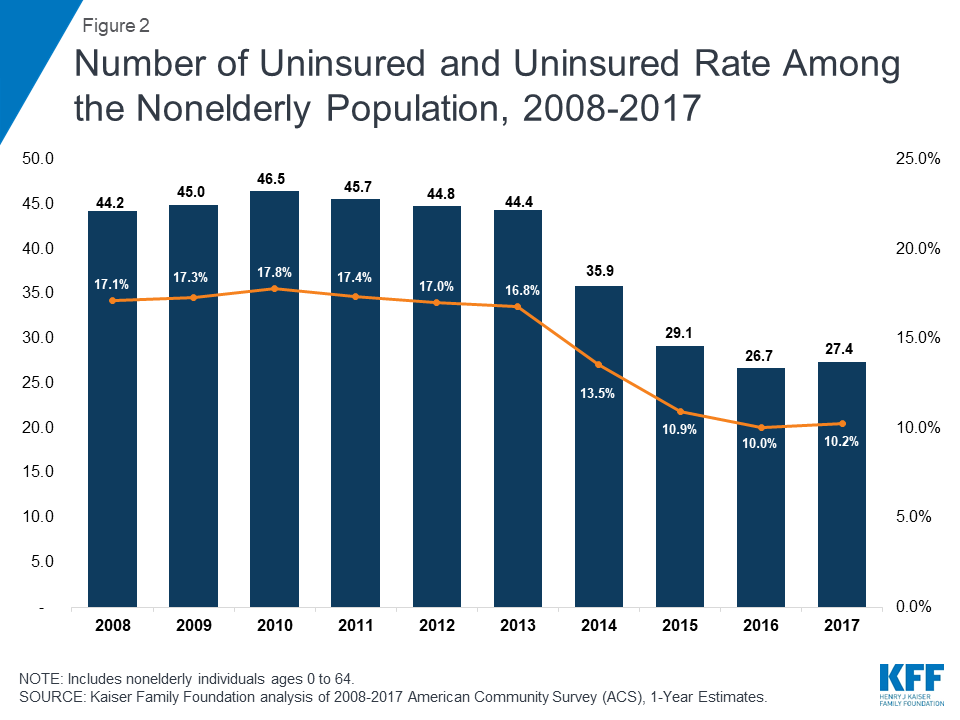

For income -based subsidy eligibility a household must have an income of at least 100 of the federal poverty level 139 of the federal poverty level in states that have expanded. 2015 ACA Obamacare Income Qualification Chart. Premium subsidies are normally available if your projected household income an ACA-specific calculation doesnt exceed 400 of the prior years poverty level.

Estimating your expected household income for 2022. Depending on the number of members there are the minimum income that qualify for the subsidy 100 of FPL and the maximum income 400. If your income is above 400 you will not qualify for a subsidy.

If your pay stub lists federal taxable. For a single individual in 2017 the upper income limit for Medicaid eligibility was 16642 and for a family of four the upper income limit was 33948. Before the American Rescue Plan was enacted a single individual in the continental US.

The chart below shows common types of income and whether they count as part of MAGI. Medicaid health coverage if your state decides to offer it Up to 17775 Up to 36570 Help to pay your premium if you buy in your states online marketplace Between 12880-51520. Higher than 38060 and lower than 152240.

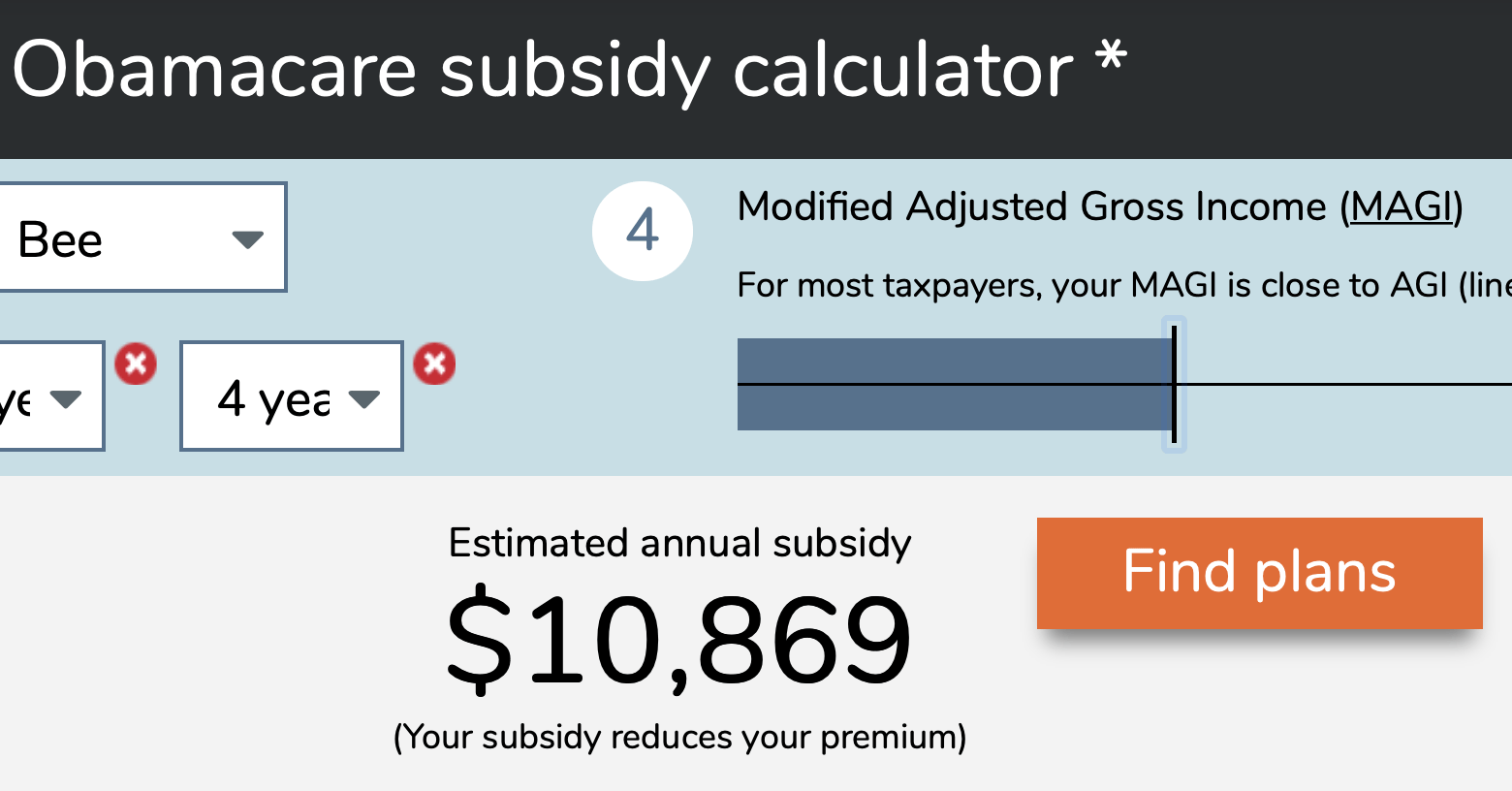

Was ineligible for subsidies in 2021 if their income exceeded 51040. Savings are based on your income estimate for the year you want coverage not last yearUse our income calculator to make your best estimate. Medicaid health coverage if your state decides to offer it Up to 17775.

Federal Taxable Wages from your job Yes.