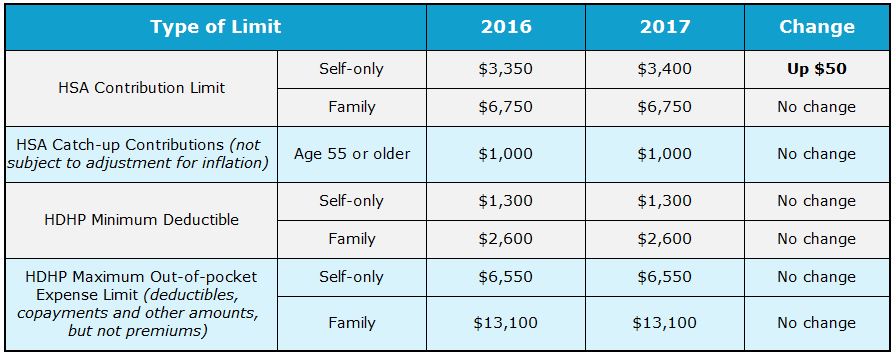

2017 Hsa Contribution Limits Chart

These limits are the same as the 2016 limits.

2017 hsa contribution limits chart. The Low-Down on HSAs. It also includes the catch-up contribution limit that applies to HSA-eligible individuals who are age 55 or older which is not. This amount is an increase of 50 over 2016 HSA contribution limits.

Family HSA - 6750. To qualify as a HDHP in 2017 a plan must have a minimum annual deductible of 1300 for self-only coverage the same as for 2016 or 2600 for family coverage also the same as for 2016. Minimum annual deductibles are 1300 for self-only coverage or 2600 for.

HSA Contribution Limits Coverage. HSA holders can choose to save up to 3350 for an individual and 6650 for a family HSA holders 55 and older get to save an extra 1000 which means 4350 for an individual and 7650 for a family and these contributions are 100 tax deductible from gross income. The 2017 minimum annual deductible for self-only HDHP coverage is 1300 and the minimum annual deductible for family HDHP coverage is 2600.

The only change from 2016 to 2017 is that individuals will see an increase of 50 to their contribution limits which raises the limit from 3350 to 3400 for their HSAs. 2017 minimum annual deductibles. For 2016 For 2017 Change.

Individual HSA - 3400. 2017 HSA contribution limits. Any increase would require statutory change.

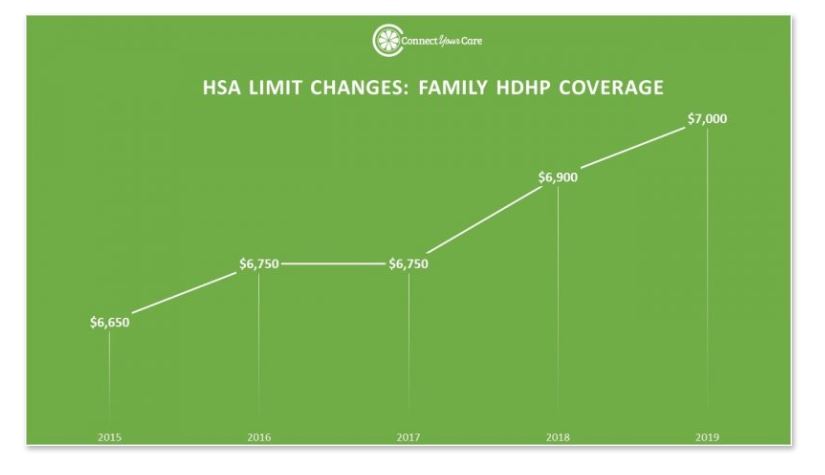

When compared to the 2017 limits the 2018 HSA contribution limits for individual coverage increased 50 and 150 for family coverage. Learn a little more about the benefits of using a QHDHP and an HSA over a traditional health plan by viewing this HSA presentation. The following chart shows the HSAHDHP limits for 2017 as compared to 2016.

You have many banks to choose from when it comes to opening an HSA but we find HSA Bank to provide the best overall options that suit most. 2017 HSA Contribution Limits. 2 rows 2017 offers individuals and families additional opportunities to save for current and future.

3400 50 increase from 2016 Family. Limit-55 or Over. 4 rows 2017.

6 rows Contribution and Out-of-Pocket Limits for Health Savings Accounts and High-Deductible Health. HSA contribution limit employer employee Individual. HSA catch-up contributions age 55 or older 1000.

The 2017 annual HSA contribution limit for individuals with self-only HDHP coverage is 3400 and the limit for individuals with family HDHP coverage is 6750. Self-Only HSA Contribution Limit. 2017 HDHP maximum out-of-pocket amounts.

Youre single and your employer contributes 400 to your HSA as a perk for signing up. Individuals will be able to contribute 3400 to their HSA in 2017 a 50 increase while families contributions will remain the same as in 2016. The HDHP cost-sharing limits for 2017 apply for plan years beginning on or after Jan.

Furthermore the HDHP minimum deductible and the HDHP maximum out-of-pocket also increased. Catch-up contributions can be made any time during the year in which the HSA participant turns 55. The maximum contribution limit includes both the employee and employer portion.

2017 DEDUCTIBLES CONTRIBUTIONS. For the calendar year 2017 you can contribute an HSA maximum of 3400 for an individual and 6750 for a family. Unlike other limits the HSA catch-up contribution amount is not indexed.

In May 2016 the IRS released new Health Savings Account Guidelines for contribution limits in 2017. IRS Revenue Procedure 2016-28 released in May 2016 outlines the HSA contribution limits health plan deductible and maximum out of pocket limits for tax year 2017 as outlined in the table below. Families will not see an increase.

For 2017 the annual contributions to an HSA are 3400 for an individual and 6750 for a family. Lastly catch-up contributions for individuals 55 or older remained the same at 1000. A Health Savings Account is a savings account you use for healthcare expenses a bit like a medical IRA.

Savers aged 55 and over can make an optional catch-up contribution of up to 1000 each year.